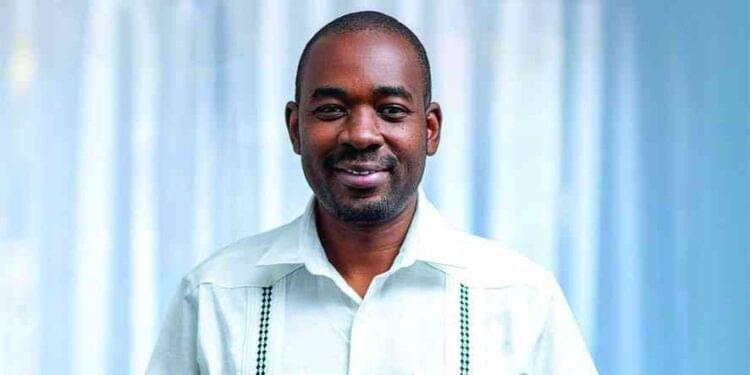

Opposition leader Nelson Chamisa has strongly criticized the government’s proposed introduction of a currency board as an attempt to revive the struggling Zimbabwe dollar, stating that it will ultimately fail.

Earlier this week, Finance Minister Mthuli Ncube announced that the government was contemplating implementing a currency board to stabilize the local currency, which has been experiencing significant depreciation.

Under this plan, the currency board would tie the exchange rate to tangible assets like gold.

Chamisa denounced the currency board proposal as yet another futile effort by the government to restore confidence in the local currency.

“The currency crisis facing Zimbabwe is fundamentally a crisis of confidence. Simply establishing a currency board or implementing a structured currency framework cannot address this confidence deficit crisis. Past endeavors, including the introduction of bond notes, gold coins, and ZIG, have all ended in dismal failure,” remarked Chamisa.

Expressing skepticism towards the asset-backed currency approach, Chamisa highlighted previous unsuccessful attempts, such as the introduction of gold-backed digital coins, which resulted in discounted gold sales and increased resource smuggling out of the country. He also criticized the lack of transparency surrounding the proposed strategy, undermining public trust.

Chamisa questioned the government’s capability to execute the proposed plan successfully.

“In countries where currency boards have succeeded, accountability, transparency, and adherence to legal frameworks have been crucial—qualities sorely absent in Zimbabwe’s governance. The prevailing state policy inconsistency further erodes confidence. Without these essential elements, the currency board is destined to fail,” he asserted.

Chamisa acknowledged the potential effectiveness of currency boards in certain contexts but emphasized the need for credible and trustworthy leadership to implement them. He also stressed the importance of adequate foreign reserves to support the pegged exchange rate.

The currency board represents the latest effort by the government to stabilize the local currency, which continues to depreciate, with most Zimbabweans preferring the US dollar.

Earlier this month, President Emmerson Mnangagwa announced plans to establish a “structured currency” to combat Zimbabwe’s hyperinflation.

Chamisa argued that comprehensive political and economic reforms are necessary to address the country’s deep-rooted challenges, including a confidence deficit, external shocks like drought and fluctuating commodity prices, and currency leakage. He criticized the government’s reliance on ineffective fiscal and monetary policies, advocating instead for genuine reforms prioritizing accountability, transparency, and the rule of law to build a stable and prosperous economy.

Source Bulawayo 24