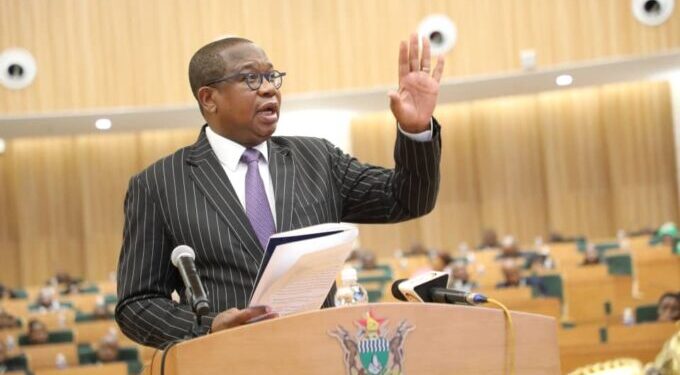

Finance Minister Mthuli Ncube says government workers will soon receive a pay rise as part of measures to cushion them from the shocks created by a recent Reserve Bank of Zimbabwe (RBZ) decision to devalue the ZiG by over 40 percent.

Speaking publicly for the first time since the shock currency devaluation, Ncube said the move was aimed at reducing the gap between the official and parallel market value of the local currency.

The Treasury chief said government was aware that wages were affected by the induced fall of the ZiG hence the need to restore their buying power.

“Putting in place a flexible exchange rate or devaluation does have an impact immediately on incomes, on prices,” Ncube said.

“And for us as a government, we will make some adjustments, naturally, to civil service salaries to make sure that the purchasing power of the salaries is somewhat restored.

“Maybe not in full, but because someone wants to get in there. So, there is bound to be pain, there’s bound to be impact, and that’s what happens with any policy.

“Any policy does have negative impacts and that’s what will happen. But we will make some adjustments to make sure that those who are losers can be compensated somewhat.

“It won’t be everybody who will be looked after, but we’ll do our best,” he said in interviews with journalists soon after President Emmerson Mnangagwa had delivered his State of the Nation Address (SONA) before parliament on Wednesday.

On measures announced by the central bank last week, Ncube said it shows the government remains determined to stabilise the economy.

“So, what the Reserve Bank put in place was a package of measures to really deal with the issue of currency stability.

“Now, when it comes to the issue of allowing the exchange rates to move to ZiG 25, the intention there was to make sure that the gap between the parallel market and the official market is somewhat narrowed.

“The idea is that you want to discourage speculative demand for credit, for speculation in the parallel market.

“The other measure that the central bank put in place was to increase the reserve requirement for loans, for both domestic loans as well as foreign loans,” he said.

In his SONA, Mnangagwa admitted the government’s difficulties to control the parallel market.

“…We note with concern the resurgence of parallel market activities driven by speculative tendencies.

“Corrective measures are being instituted to protect all Zimbabweans from economic disruptions,” he said.